URBAN REHABILITATION INCENTIVES PROGRAMME IN PORTUGAL

There are various government and municipal incentives in Portugal aimed at the rehabilitation of urban areas, buildings and even apartments that are either located in designated neighbourhoods or else have been built more than 30 years ago and are in need of rehabilitation work. Such rehabilitation is encouraged in Portugal by a legal framework which, among other measures, provides for the following:

- Simplified and quick planning permission procedures;

- Simplified and quick eviction of long term tenants who would otherwise have a right to extend their tenancy rights indefinitely;

- Various tax breaks;

- Special financing schemes.

This paper briefly describes these official incentives, particularly from the point of view of prospective real estate investors in Portugal. This is a description of a general nature and cannot preclude specialised technical advice in connection with specific situations.

Eligibility

Buildings and apartments that are eligible to benefit from the rehabilitation incentives programmes are essentially those located in neighbourhoods specifically designated by the relevant municipality or else that have been built more than 30 years ago and are in need of rehabilitation work.

Regardless of whether or not the same property use is kept, the benefits are granted on the condition that the rehabilitation work results in a property preservation condition that is at least “two levels” above that existing before the work, as certified by the local municipality before and upon the conclusion of the rehabilitation work.

In order to qualify, the rehabilitation work has to comply with the following main requirements:

- The building façades, as well as any architectural and structural elements deemed of heritage value, have to be preserved;

- The number of floors above and below ground level, plus the roofing configuration, cannot be changed;

- The structural resistance of the building cannot be negatively affected.

Each municipality has its own rehabilitation specific programmes and special procedures, but in general it can be said that they have all enthusiastically embraced the urban renovation opportunities afforded by the national programme. The municipality of Lisbon, for example, designated almost all of the city’s neighbourhoods as urban rehabilitation areas eligible to benefit from the tax incentives.

Planning Permission

Under a law passed in 2012, rehabilitation works benefit from a simplified and quick planning permission procedure based on a system of prior communication by the developer to a single body appointed by the municipality to oversee rehabilitation works. Under this system, the developer’s technical expert (qualified architect and/or engineer) assumes responsibility for the conformity of the planned works to existing regulations, and planning permission is automatically granted within 20 days of the communication, unless the municipality decides to oppose the plan within this time frame, which it can only do on certain specific grounds. Likewise, upon conclusion of the works, the property usability and, if applicable, its division into separately-owned apartments, will be speedily licensed by the municipality on the basis of a communication by the expert who took responsibility for the works.

Old Tenancy Rights

With a view to encourage rehabilitation works in rented properties, a law was passed in 2012 that provides for some fundamental changes to the rights of long term tenants, notably the following:

- There has been a drastic reduction of exceptional tenants’ benefits regimes;

- A tenant can be evicted on the grounds that the landlord has requested from the municipality planning permission to do rehabilitation work;

- A court order ceased to be necessary for the eviction of a tenant, it being enough for the landlord to give a six-month formal notice to the tenant;

- Where a tenant is entitled to compensation, its maximum amount will be that of one year’s rent or 1/15 of the official value of the property.

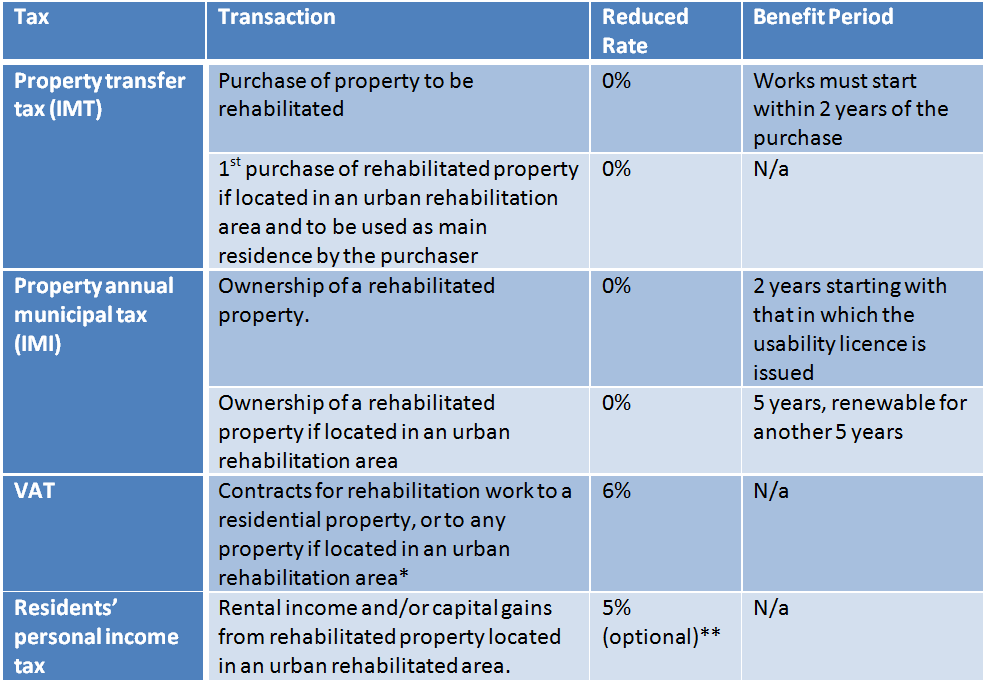

Tax Incentives

The most relevant tax incentives to property rehabilitation are shown in the following table.

- Option 1 – Equal instalments of capital and interest.

- Option 2 – at least 70% of the loan + interest on up to 30% of the loan in equal instalments, the remaining capital and interest being payable at the end of the term.

Belion Partners LLP | Registered in England, No. OC382877 | VAT Reg. No. GB 157104723

Registered office: 5 St John's Lane, London EC1M 4BH, United Kingdom | tel +44 203 004 8972

Belion Portugal | www.belionportugal.com | A Belion Network Member

Lisbon: Av. Antonio Augusto de Aguiar 74, R/c Dto, 1050-018 Lisboa, Portugal | tel +351 211 450 644