House Insurance in Portugal: Complete Guide to Protecting Your Home

Author:

Nádia Lavaredas | Property Manager

Imagine coming home after a long day at work. You are ready to relax, but as soon as you open the door, you find the living room flooded; a pipe burst while you were away. Or picture this: you return from holidays to discover the door broken and half your belongings gone.

These situations are not rare, and they can quickly turn into nightmares… unless you have house insurance in Portugal.

Why You Need House Insurance in Portugal

Many people see house insurance as just another formality, something required by law or banks. But in reality, home insurance in Portugal is a safety net that protects you against unexpected events such as fires, floods, and burglaries. Without it, you could be facing thousands of euros in repairs, replacements, and liability costs, not to mention sleepless nights.

In Lisbon, as in many cities around the world, accidents in apartments are quite common. A single water leak can damage not only your property but also your neighbour’s ceiling. With the right home insurance in Lisbon, you won’t be left to deal with these expenses alone.

Is House Insurance Mandatory in Portugal?

Yes! Portuguese law requires all apartment owners in condominiums to have at least fire insurance. However, most homeowners choose more complete coverage, known as multi-risk house insurance, because it protects not only the walls of the property but also furniture, appliances, electronics, and personal belongings.

But perhaps the greatest benefit of house insurance is the peace of mind it brings. Knowing that, whatever happens, you have support to repair damage, replace items or simply reduce the financial impact gives you a sense of freedom that is hard to put into words. You can enjoy your house, go on holidays or even rent out your property, confident that if something goes wrong, you will not be left to deal with the consequences on your own.

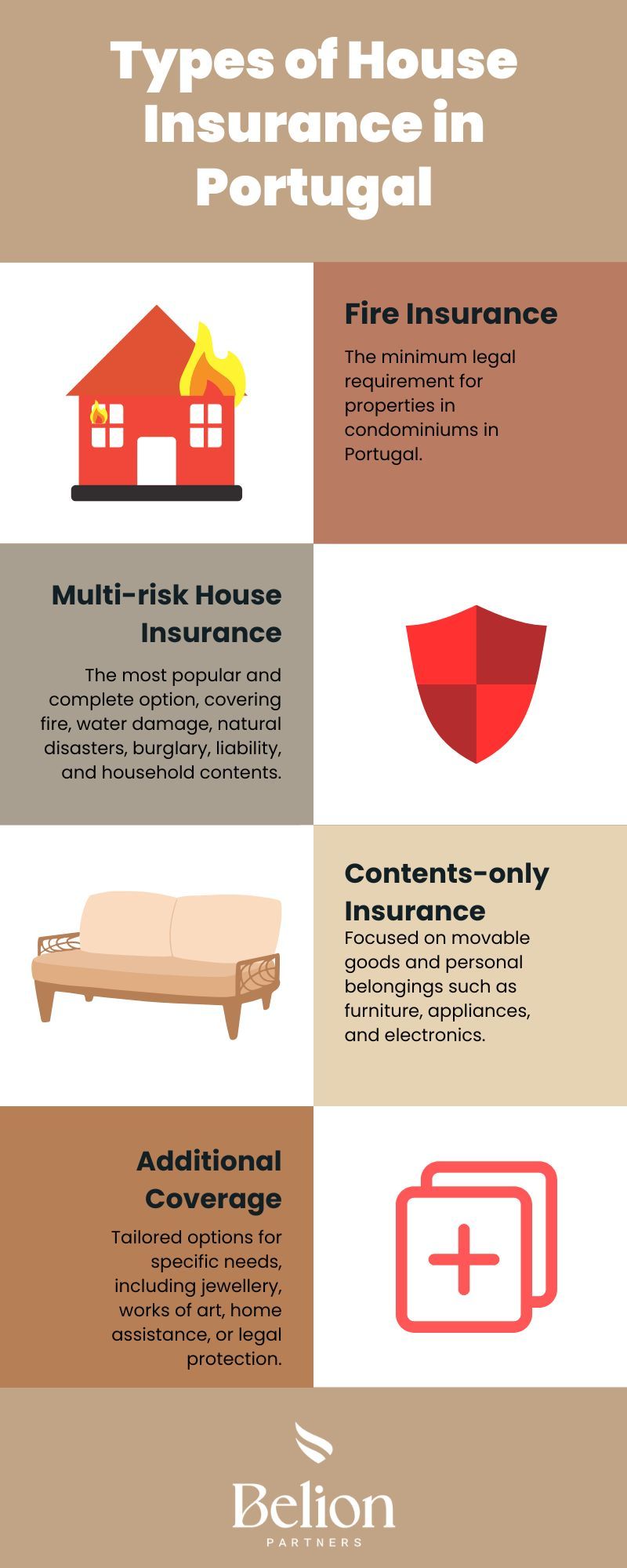

Types of House Insurance in Portugal

When looking for the best house insurance in Portugal, you’ll come across several policy options:

Fire Insurance

The minimum legal requirement for properties in condominiums.

Multi-risk House Insurance

The most popular and complete option, covering fire, water damage, natural disasters, burglary, liability, and household contents.

Contents-only Insurance

Focused on movable goods and personal belongings such as furniture, appliances, and electronics.

Additional Coverage

Tailored options for specific needs, including jewellery, works of art, home assistance, or legal protection.

How to Choose the Best House Insurance Policy

Choosing home insurance in Portugal is not just about finding the cheapest option. It’s about making sure the coverage fits your needs. Here are some factors to consider:

- The value of your property and contents.

- Whether the home is your main residence, a rental, or short-term accommodation (like Airbnb).

- The risks are specific to your location. For example, house insurance in Lisbon may need stronger coverage for apartment buildings and shared spaces.

- Additional protections, such as liability coverage, are needed to avoid disputes with neighbours or tenants.

Comparing quotes and understanding the small print is essential. A basic policy might look attractive until a serious incident happens, and then you’ll wish you had invested in broader coverage.

House Insurance in Lisbon: What to Know

Lisbon has one of the highest concentrations of apartment buildings in Portugal, which means risks are often shared between neighbours. Multi-risk house insurance in Lisbon usually includes liability coverage for water leaks, fire damage, or accidents that could impact other apartments or condominium areas.

If you are buying or renting a property in Lisbon, make sure your insurance also covers:

- Common areas such as roofs, staircases, and elevators.

- Short-term rental activity (if you plan to host tourists).

- Higher-value personal belongings like electronics, jewellery, or art.

FAQs about House Insurance in Portugal

Is house insurance mandatory in Portugal?

Yes, fire insurance is required by law for apartment owners in condominiums.

How much does house insurance cost in Portugal?

On average, basic policies start at €100–€150 per year, while multi-risk home insurance in Portugal can range between €200 and €650 annually, depending on coverage and property value.

Can foreigners buy house insurance in Portugal?

Yes, both residents and non-residents can take out home insurance, whether they live in the country or own property as an investment.

What is covered by multi-risk home insurance?

Multi-risk policies typically include fire, water damage, natural disasters, theft, liability, and household contents.

Peace of Mind Is Priceless

In the end, home insurance in Portugal is like wearing a seatbelt: it won’t prevent accidents, but it will make all the difference when they happen. Protecting your property is not just about walls and roofs; it’s about safeguarding your financial stability, your memories, and the well-being of your family.

Because protecting your house is not just about walls and roofs. It is about safeguarding memories, stability and, above all, the well-being of those who live there.