Whichever form of residency you may choose, at Belion Partners, our experts will assist you with all of the necessary formalities, cutting down on delays and rejected applications.

Portugal has a special charisma for everyone looking to relocate, offering captivating residency programs, which cover expats who wish to invest, work, and live in a country with 850 kilometres of cost line, enticing destinations, an average of 300 days of sunny weather and an affordable cost of living.

There are various options available, and for every client, we can identify the permit that would be most suitable for each individual circumstances. Some options are only appropriate for citizens of the European Union, the EEA and Switzerland, while other pathways to full residency are available for other citizens, including investors, passive income earners, qualified professionals, and business people.

Portugal Residence Permits

-

Digital Nomad Visa

ButtonWorking remotely, running a business, or simply staying in Portugal

-

Golden Visa

ButtonResidency by investment allowing free entry and circulation in Portugal and Schengen Space countries

-

D7 Visa

ButtonPassive income earners, including retirees, who intend to move to Portugal

-

D2 Visa

ButtonFor entrepreneurs, freelancers, and independent service providers

-

D3 Visa

ButtonHighly qualified professionals seeking to obtain residency in Portugal

-

Startup Visa

ButtonEntrepreneur(s) intending to develop an entrepreneurial and/or innovative business in Portugal

-

Student Visa

ButtonResidence permit for studying in Portugal

-

Family Reunion Visa

ButtonThe holder of a residence permit may be joined by his/her immediate family members

EU, EEA and Swiss Citizens

For citizens of the European Union, the European Economic Area and Switzerland, there are only two mandatory requirements for Portuguese residency:

- First, a five-year Residence Certificate must be obtained at AIMA – Agency for Integration, Immigrations and Asylum via the local Town Hall - this will be signposted as the "Câmara Municipal".

- Secondly, it is compulsory to register for tax purposes at any tax office (Repartição de Finanças) or Citizens' Shop (Loja do Cidadão).

Shortly before five years have elapsed, you will need to return to the Town Hall to swap the Residence Certificate for a Permanent Residence Certificate, and the process is repeated every five years after that.

Residence Card for non-EU/EEA/Swiss Family Members

After registration of the EU/EEA/Swiss citizen, his or her non-EU/EEA/Swiss spouse (or common law spouse of at least 3 years), dependent children and dependent parents may apply for a residence card, renewable every 5 years.

Loss of permanent residency rights

Having acquired permanent residency rights for having resided in Portugal for a period of 5 years, an EU citizen and his or her dependent relatives will only lose such rights in the event of an absence from Portugal for a period that exceeds 2 consecutive years or in the event a valid decision is made to expel him or her from the country.

Non-EU, EEA and Swiss Citizens

The different types of Portugal residence permits that may be applied for by non-EU/EEA/Swiss citizens are as follows.

Permits that may be applied for in Portugal with no need for previously obtaining a Portugal residence visa from the Portuguese consulate serving the area of the former residence of the applicant:

- The residency-by-investment permit, commonly known as a "Golden Visa".

- A permit for Family Reunification.

- A permit applied for by the holder of a long-term residence permit issued by another EU-member state.

- A permit applied for by a victim of human trafficking.

Permits that are applied for in Portugal, but are required to be preceded by a special-purpose Residence Visa obtained from the Portuguese Consulate serving the area of the former residence of the applicant:

- A permit applied for by remote workers, known as the Digital Nomad Visa, which is presented in two different types, depending on how long you plan on staying in Portugal: Temporary Stay and Residence Visa.

- A permit applied for by a retiree, a passive income earner or a high net-worth individual, also known informally as a Passive Income Visa or a D7 Visa.

- A permit to carry out a professional activity in Portugal as an employee, a researcher, a teacher at a higher education institution or a highly qualified professional*, also known as D3 Visa.

- A permit to carry out a professional activity as a freelancer or to set up a business as an entrepreneur*, otherwise called D2 Visa.

- The Start-up Visa, which may be applied for by an entrepreneur, or by a group of up to 5 entrepreneurs, intending to develop an entrepreneurial and/or innovative business in Portugal under an agreement with an accredited Portuguese incubator*.

- The EU Blue Card, which is granted to highly qualified professionals having a highly paid contract of employment, except where the applicant already holds a right to reside in Portugal.

- A permit applied for to study, do a non-remunerated internship or do voluntary work.

- A permit applied for by a qualified minister of an established religion.

* Permits 5 to 7 above may, under some circumstances, be directly applied for in Portugal

Favourable Tax Regime for New Residents

People who move to Portugal and were not tax-resident in this country during at least the previous 5 years, may apply for "non-habitual resident" (NHR) status. This is a regime that grants a new resident of Portugal a 10-year tax exemption or low tax on most non-Portugal-sourced types of income, whether or not they are effectively taxed at source, and whether or not, under a double taxation agreement (DTA), tax at source is reduced (e.g. on dividends, interest or royalties) or even eliminated (e.g. on pension income derived from private sector employment).

The Portuguese tax regime for non-habitual residents is nearing termination, with the deadline for benefiting from it set at the end of 2023. Discover how you can take advantage of this unique opportunity.

Moving to Portugal?

All the services you need, in one place

We have what it takes to ease your journey

Temporary Residency

Except for the permits to study (valid for 1 year and renewable annually for the duration of the course of studies) or to do a non-remunerated internship or voluntary work (effective for the duration of the relevant programme and not renewable), all types of residence permits granted to non-EU/EEA/Swiss citizens by Portugal are initially issued for a period of two years and are subsequently and indefinitely renewable every two or three years.

Permanent Residency or Citizenship after 5 years

After having held legal Portugal residency for 5 years and subject to passing the A2 level Portuguese test, you are entitled to

permanent residence or citizenship.

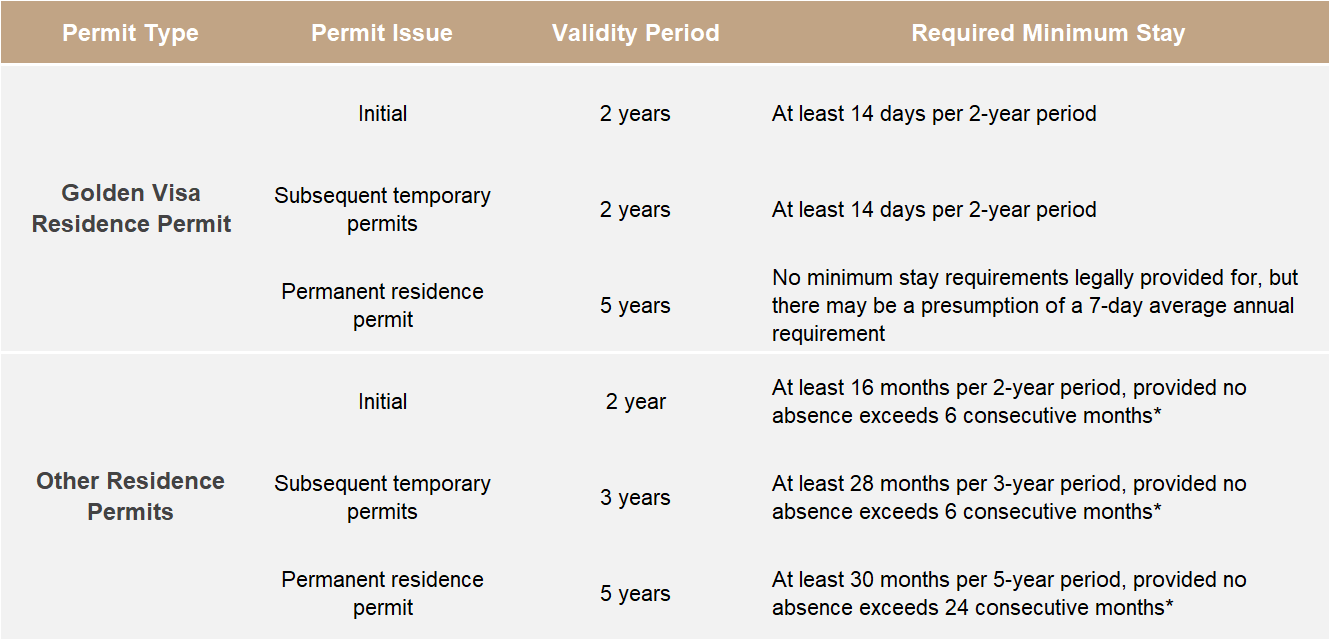

Minimum Stay Requirements

The following minimum stay requirements apply to the different types of residence permit available to non-EU/EEA/Swiss citizens:

* Maximum absence periods may be exceeded for duly proven professional or force majeure reason.

Moving to Portugal?

Favourable aspects of moving to Portugal:

- You will gain free entry and circulation within the Schengen Area, comprised of 26 European countries, without a Visa.

- You can apply for Portugal’s Non-Habitual Resident (NHR) tax regime, becoming tax resident of a white-listed jurisdiction whilst legally avoiding or minimising income tax on certain categories of income and capital gains for a period of 10 years.

- Portuguese residency rights, including education and health care: as a Portuguese resident you and your family will have access to the Public Healthcare System and your children to the Public Education System.

The Portuguese tax regime for non-habitual residents is nearing termination, with the deadline for benefiting from it set at the end of 2023. Discover how you can take advantage of this unique opportunity.

How can Belion assist with obtaining a Portugal Residence Permit?

Belion provide a one-stop shop for all your needs in connection with your relocation to Portugal, including your residence permit, tax affairs, property search and settling-in support. Having assisted hundreds of clients with a 100% success rate, we are at ease with meeting a great variety of disparate requirements.

Have a question? Contact us

We will respond by email within no longer than one working day.

Belion Partners LLP | Registered in England, No. OC382877 | VAT Reg. No. GB 157104723

Registered office: 5 St John's Lane, London EC1M 4BH, United Kingdom | tel +44 203 004 8972

Belion Portugal | www.belionportugal.com | A Belion Network Member

Lisbon: Av. Antonio Augusto de Aguiar 74, R/c Dto, 1050-018 Lisboa, Portugal | tel +351 211 450 644